What Does “Direct Market Access” Really Mean?

In financial markets, Direct Market Access (DMA) is a term frequently used but not always fully understood. It refers to the ability of a trader to send electronic orders to an exchange or trading venue (Market Center) rather than routing them through a broker-managed desk.

DMA gives traders a higher degree of control over order placement, speed, and execution monitoring. While it does not change market outcomes or create advantages in price prediction, understanding DMA is key to recognizing how access, responsibility, and risk are allocated in trading operations.

The Concept of Direct Market Access

At its core, DMA provides the following:

- Electronic orders are submitted to the broker’s DMA gateway (where risk checks like fat-finger limits, exposure limits, and kill switches are applied) and on to the exchange gateway, which validates the order format, price and quantity as well as other parameters. From that point, the exchange treats the order in the same way as other orders. If the order passes the exchange’s validation checks and order acknowledgment (ACK) is sent back to the trader with the assigned order number.

- The order reaches the market center’s order book for that security. Aggressive orders (market orders or limit orders that cross the spread) immediately attempt to match against the opposite side of the book. Passive orders (non-crossing limit orders) are added to the appropriate side of the order book (bids or offers).

- The trader can monitor executions in real time

- The trader can receive electronic trade reports

DMA does not imply insider access, guaranteed execution, or a faster path to profits. Instead, it provides electronic connectivity through the broker-dealer’s system to the market’s technical and regulatory framework.

How DMA Works

Direct Market Access relies on secure connectivity and pre-configured infrastructure. The general flow includes:

1. Trading system connection: The trader connects their trading system to a broker-dealer network for electronic routing to an exchange or market center. The broker-dealer checks and validates the order.

2. Pre-trade controls: Risk and compliance checks are performed automatically before an order is submitted to the market center.

3. Order transmission: Orders are then sent to the exchange.

4. The exchange performs validation of the order format, price and quantity as well as other parameters.

5. The order is compared against the market center’s order book for that security and executed or posted in the order book.

6. When a match happens, one or more trades are executed (order may be filled, partially filled, or executed against multiple counterparties.)

7. The order book is updated in real time (relevant resting orders are reduced or removed).

8. Both the buyer and seller receive electronic execution reports with price, quantity, time, and execution ID.

Even with DMA, brokers retain control and oversight responsibilities for regulatory compliance, risk monitoring, and reporting for orders sent through DMA to comply with defined operational and legal requirements.

Key Features of DMA

Speed and Transparency

DMA enables traders to see trade reports in real time. This transparency allows traders to monitor executions without intermediary delays.

Control Over Orders

With DMA, traders have the ability to:

- Select the order type (market, limit, etc.)

- Determine timing and routing parameters

- Adjust or cancel orders quickly as conditions change

This contrasts with broker-managed routing, where decisions about timing, routing, and execution strategy are handled by the broker’s trading desk.

Pre-Trade Risk Checks

DMA is accompanied by pre-trade risk controls to ensure compliance with financial and regulatory requirements. Checks may include:

- Maximum order size

- Capital and margin requirements

- Exposure limits per security or venue

- Borrow locates for short sales

- Regulatory requirements

These controls are automated and operate before orders reach the exchange.

Responsibilities of DMA Traders

Direct access comes with operational and compliance responsibilities. Traders must understand:

- Order accuracy: Incorrect order details can lead to unintended market activity or rejected trades.

- Risk management: Traders must continuously monitor positions and exposure.

- Regulatory obligations: Even with direct access, trade reporting, recordkeeping, and compliance with market rules remain the trader’s responsibility.

Because DMA bypasses certain broker decision-making, the trader assumes greater accountability for their own orders.

Misconceptions About DMA

Several misunderstandings about DMA are common:

- DMA does not bypass the broker-dealer’s system.

- DMA does not guarantee faster execution. While it reduces intermediary steps, latency depends on network quality and venue capacity.

- DMA is not a shortcut to profits. Direct access allows control, but market outcomes are still determined by supply, demand, and market conditions.

- DMA is not risk-free. Greater control comes with greater responsibility for monitoring orders, managing errors, and complying with rules.

- DMA is regulated. Brokers providing DMA maintain oversight to ensure traders meet all applicable regulatory and operational requirements.

When DMA Is Used

DMA is commonly employed in contexts such as:

- High-frequency or algorithmic trading, where direct order placement and monitoring are needed

- Proprietary trading, where firms manage their own execution strategies

- Institutional trading, for precise control over large orders

- Situations requiring immediate reaction to market conditions, within the constraints of pre-trade checks

Even in these contexts, DMA does not change market mechanics or outcomes — it simply provides a direct interface between the trader’s system and the broker’s system.

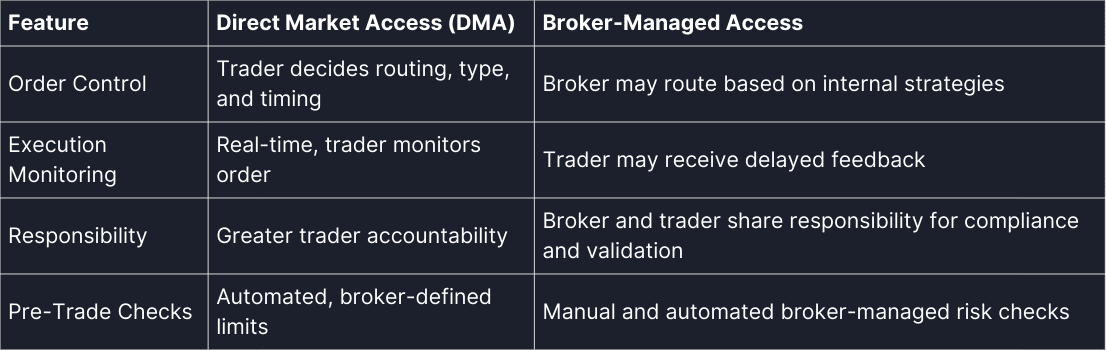

Comparing DMA to Broker-Managed Access

Although DMA and broker-managed access are both available and widely used, they differ in several ways:

These distinctions explain why DMA is generally reserved for experienced traders or organizations with sophisticated infrastructure and risk management in place.

Operational Considerations

Even when using DMA, operational factors affect how effectively orders are handled:

Network latency: Physical distance and connectivity quality impact order arrival times.

System capacity: The trader, the broker, and the exchange must all handle message volume efficiently.

Message sequencing: Orders are processed based on time and price though some venues use pro-rata, FIFO with allocations, or other algorithms; maintaining proper order sequence integrity is critical.

Error handling: Systems and traders must detect and respond to rejected or partially filled orders quickly.

DMA traders often coordinate with brokers or IT teams to monitor system health, performance, and reliability.

Regulatory Context

DMA does not exempt traders from any regulatory rules. Firms comply with:

- Pre-Trade risk controls

- Order routing and best execution obligations

- Trade reporting and recordkeeping requirements

- Market conduct and anti-manipulation rules

- Risk and margin regulations

Brokers providing DMA usually implement pre-trade controls to support these obligations, but ultimate responsibility remains with the trader.

Summary

Direct Market Access allows traders to submit electronic orders to broker-dealer systems for automated submission to exchanges, providing greater transparency, speed, and control over order execution. It is not a tool for predicting markets, guaranteeing profits, or bypassing regulations.

DMA requires understanding of operational responsibilities, risk management, and compliance obligations. Traders retain accountability for their orders while benefiting from a faster interface with the market.

Understanding DMA provides insight into how market access works, where various controls lies, and how responsibilities are distributed between traders and brokers. This knowledge is a foundation for further exploration of execution mechanics, trading infrastructure, and market data processing.

© 2026 Securities are offered by Lime Trading Corp., member FINRA, SIPC, NFA. Past performance is not necessarily indicative of future results.

All investing incurs risk including, but not limited to, the loss of principal. Additional information may be found on our Disclosures Page.This material in this communication is not a solicitation to provide services to customers in any jurisdiction in which Lime Trading is not approved to conduct business. This communication has been prepared for informational purposes only and is based upon information obtained from sources believed to be reliable and accurate; however, Lime Trading Corp. does not warrant its accuracy and assumes no responsibility for any errors or omissions. The information provided is not an offer to sell or a solicitation of an offer to buy any security or a recommendation to follow a specific trading strategy. Lime Trading Corp. does not provide investment advice. This material does not and is not intended to consider the particular financial conditions, investment objectives, or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.